The VA Loan Certificate of Eligibility

The VA Certificate of Eligibility (COE) you need to apply for a VA home loan is one of the most important documents in the group of items you must submit to a participating VA lender. The VA COE is your gateway to the VA home loan program and without it, you can’t officially move forward with a VA mortgage application.

You will need a VA COE whether applying for a typical VA purchase loan, a VA refinance loan or a VA Native American Direct Loan.

Who Is Eligible to Apply for A VA COE?

Some do not realize that many categories of people are eligible to request a VA COE once they have met their time-in-service requirements (see below). These include:

- Active duty military

- Retirees and veterans

- Qualifying surviving spouses of military members who died as a result of military service

- Guard and Reserve members

- Public Health Service officers

- National Oceanic and Atmospheric Administration officers

- Cadets, Midshipmen, and those at the Coast Guard Academy

- Merchant seaman who served during World War II

The time-in-service requirements for each of these categories depend greatly on the era of service. For example:

Those currently serving on active duty must serve 90 consecutive days outside of training. Those who served from August 2nd, 1990 to the preset must meet one of the following VA criteria:

- 24 continuous months of military service OR;

- The full period (at least 90 days) for which you were called or ordered to active duty OR;

- At least 90 days if you were discharged for hardship, a reduction in force, or for convenience of the government OR;

- Less than 90 days if you were discharged for a service-connected disability.

National Guard Service

Those who served in the National Guard and have 90 days of active duty service (30 days must be served consecutively) may qualify for VA home loan benefits even if they were previously denied VA loan benefits under older VA loan policy. If you served in the Guard and meet the active duty criteria, apply for a VA certificate of eligibility again, you may now qualify for VA loan benefits thanks to VA policy changes in 2024.

The full list of service eras is lengthy–it’s best to discuss your COE needs directly with the VA or with a participating lender if you aren’t sure what your time-in-service commitment must be to qualify.

RELATED: VA Loan Requirements: What You Need to Know

Applying for Your VA Certificate of Eligibility for A VA Mortgage

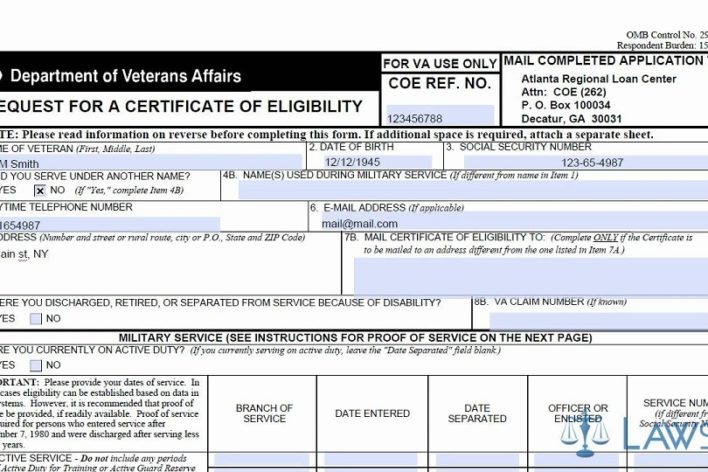

Depending on the nature of your military service, you may have different requirements to obtain your COE. The first thing you will need to do is gather your documents which will include VA Form 26-1880 or its electronic equivalent.

You can apply by mail, the VA’s web portals such as eBenefits, or apply with the help of your participating lender.

If you are retired or separated, you must submit copies (never originals) of your retirement or separation paperwork. For active-duty military members, this will be your DD Form 214, for others such as Guard or Reserve members, the paperwork may be different.

Guard and Reservists should be prepared to show current points statements where applicable, and any relevant discharge paperwork for prior service, current service where applicable, etc.

Currently serving military members typically require a statement from their chain of command indicating that the military member is in good standing, how much active duty service commitment remains on the current commission or enlistment, when you started active duty, total years of service, any “lost time”, plus personal data such as full name, Social Security Number, etc.

You should ensure that any such letter is written as an official communication including any letterhead that might be used in such correspondence. The verification letter should not be treated as a casual document but rather one that could make or break loan approval.

If you applied for a VA COE in the past but are seeking a VA loan after many years, you may need to reapply for one, depending on the circumstances.

Those who got a COE on active duty but have since retired or separated will need a new one that reflects current military status (active, Guard, Reserve, Retired, Separated, etc.) and any applicable VA disability information that could affect your requirement to pay the VA Loan Funding Fee.

Applying for VA COE as a Surviving Spouse

Surviving Spouses have a special set of procedures to follow when applying for a VA COE.

To apply, VA Form 26-1880 must be accompanied by the veteran’s discharge documents and/or enlistment paperwork (depending on circumstances) as well as a marriage certificate, death certificate, and any paperwork showing receipt of (or an application for) VA Dependency & Indemnity Compensation (DIC) benefits.

If you need to apply for DIC,. you’ll need to include VA Form 26-1817, Request for Determination of Loan Guaranty Eligibility—Unmarried Surviving Spouses.

What the COE Tells the Lender

Your VA Certificate Of Eligibility tells your participating VA lender a variety of things including:

- How much VA loan entitlement you have to use

- Your current status in the military (active, retired, separated, Guard, Reserve, etc.)

- The last four digits of your Social Security Number

Any applicable VA entitlement code

If you have never used your VA home loan benefits before, you have 100% entitlement to use. However, you may or may not use all 100% of the entitlement for your home loan.

Any remaining entitlement is technically available to use on another VA loan at some point down the line. Those who have used their VA home loan benefits before but have paid off the original VA mortgage can apply to have their VA loan entitlement restored to 100% to use for another loan.

But that entitlement restoration is not automatic. It must be applied for and reflected on your VA COE when you go to use your VA loan benefits again. Your lender should check to see how much VA loan entitlement you have to use before approving or denying the mortgage loan.

The VA COE also tells your lender if you are currently receiving or are eligible to receive VA compensation for service-connected medical issues.

This is crucial because receipt of such VA benefits makes you eligible to apply for an exemption to the VA loan funding fee. That fee is normally calculated as a percentage of the loan and can amount to a savings of thousands depending on circumstances.

Some veterans are in the process of having a VA disability rating assigned to them while their home loans are being processed. In such cases there is a likelihood that the disability ratings won’t be made official until after the loan has closed.

In such cases, your loan officer is bound by what the VA COE tells them is current. Once your records (including your COE) are updated with the new information, you can request a refund of the VA loan funding fee. You should be exempt for having a VA Disability rating and being declared eligible to receive compensation for that rating.

As with many other VA loan issues, this option is not automatic and must be applied for.

Getting the Lender’s Help with Your VA COE

As mentioned above, it’s possible to apply for a VA COE yourself using the VA eBenefits portal, or by mail. You can also get the lender’s assistance to obtain your Certificate of Eligibility but there are some instances where the lender may not be able to help.

One of those situations is when a qualifying surviving spouse wants to apply for the VA COE. VA loan rules require these applicants to apply through the VA directly. It may be best for surviving spouses to call the VA at their toll-free number (1-800-827-1000) for the most current guidance for the COE process.

Lenders also may not be able to help service members who have had a VA loan in the past that went into loan default and foreclosure, and those who have any military discharge other than Honorable will have to contact the VA directly for assistance.

What You Need to Know About the VA Certificate Of Eligibility

When you obtain your VA COE, you have cleared the first hurdle in getting your VA home loan. But the VA COE is NOT a guarantee of loan approval. You must credit-qualify for your VA mortgage the same way you would for any major line of credit. VA loan qualifications are more lenient than some conventional mortgages, but they are not a no-credit-check home loan option.

Receiving your VA COE does not guarantee that you will be approved for a home loan. If your employment history, FICO scores, loan repayment history, and credit utilization aren’t acceptable to the lender, your home loan is likely not to be approved.

VA home loans are more affordable than some home loan options because of the no-money-down option and lower interest rates which are typical of many government-backed mortgage loan programs such as the FHA, USDA, and the VA home loan benefit.

>> Get a free, no-obligation consultation regarding your VA Loan. Get started today.

RELATED:

- VA Loan Limits

- Best Practices for the VA Loan Process

- VA Loan: Can You Borrow More Than Your House is Worth?

- VA Loan Basics

Frequently Asked Questions (FAQs)

Who can apply for a VA Certificate of Eligibility (COE)?

Eligible individuals for a VA COE include active-duty military members, retirees, veterans, qualifying surviving spouses, National Guard and Reserve members, Public Health Service officers, and certain other groups like Merchant Seamen who served during WWII. The specific time-in-service requirements vary.

How do I apply for a VA Certificate of Eligibility?

You can apply for a VA COE through the VA’s eBenefits portal, by mail, or with the help of a participating lender. Required documents include your DD Form 214 (or equivalent), retirement or separation paperwork, and for active duty members, a statement from your chain of command if you are still serving.

What does the VA Certificate of Eligibility tell the lender?

The COE informs the lender about your VA loan entitlement, your military status, and any applicable exemptions, like VA disability ratings. It also helps determine eligibility for a potential exemption from the VA loan funding fee, depending on your service-connected medical conditions.

About the author

Editor-in-Chief Joe Wallace is a 13-year veteran of the United States Air Force and a former reporter/editor for Air Force Television News and the Pentagon Channel. His freelance work includes contract work for Motorola, VALoans.com, and Credit Karma. He is co-founder of Dim Art House in Springfield, Illinois, and spends his non-writing time as an abstract painter, independent publisher, and occasional filmmaker.